Honeywell announced today that its Board of Directors completed the comprehensive business portfolio evaluation launched a year ago by Chairman and CEO Vimal Kapur and intends to pursue a full separation of Automation and Aerospace Technologies. The planned separation, coupled with the previously announced plan to spin Advanced Materials, will result in three publicly listed industry leaders with distinct strategies and growth drivers. The separation is intended to be completed in the second half of 2026 and in a manner that is tax-free to Honeywell shareholders.

"The formation of three independent, industry-leading companies builds on the powerful foundation we have created, positioning each to pursue tailored growth strategies, and unlock significant value for shareholders and customers," said Vimal Kapur, Chairman and CEO of Honeywell. "Our simplification of Honeywell has rapidly advanced over the past year, and we will continue to shape our portfolio to create further shareholder value. We have a rich pipeline of strategic bolt-on acquisition targets, and we plan to continue deploying capital to further enhance each business as we prepare them to become leading, independent public companies."

"Building on decades of innovation as its heritage, Honeywell Automation will create the buildings and industrial infrastructure of the future, leveraging process technology, software, and AI-enabled, autonomous solutions to drive the next generation of productivity, sustainability and safety for our customers," Kapur added. "As a standalone company with a simplified operating structure and enhanced focus, Honeywell Automation will be better able to capitalize on the global megatrends underpinning its business, from energy security and sustainability to digitalization and artificial intelligence."

"As Aerospace prepares for unprecedented demand in the years ahead across both commercial and defense markets, now is the right time for the business to begin its own journey as a standalone, public company," Kapur continued. "Today's announcement is the culmination of more than a century of innovation and investment in leading technologies from Honeywell Aerospace that have revolutionized the aviation industry several times over. This next step will further enable the business to continue to lead the future of aviation."

"With today's action, Honeywell will be separating its Automation and Aerospace businesses into two market-leading enterprises poised for sustained growth and value creation," said Elliott Partner Marc Steinberg and Managing Partner Jesse Cohn. "The enhanced focus, alignment, and strategic agility enabled by this separation will allow Honeywell to realize the opportunity for operational improvement and valuation upside. We look forward to continuing to support Vimal and the management team as they execute on the separation and deliver significant long-term value to Honeywell's shareholders."

The planned separations of Automation, Aerospace and Advanced Materials will create value for all stakeholders as each will benefit from:

- Simplified strategic focus;

- Greater financial flexibility to pursue distinct organic growth opportunities throughout investment cycles;

- Improved ability to tailor capital allocation priorities in alignment with strategic focus;

- Focused boards of directors and management teams with deep domain expertise; and

- Distinct investment profiles that position each company to unlock greater long-term value for shareholders.

Creating Three Industry-Leading Focused Companies

Honeywell Automation: Following the completion of the announced transactions, Honeywell will be the global leader of the industrial world's transition from automation to autonomy, with a comprehensive portfolio of technologies, solutions, and software to drive customers' productivity. Honeywell Automation will maintain global scale, with 2024 revenue of $18 billion. Honeywell Automation will connect assets, people and processes to power digital transformation, building on decades-long technology leadership positions, deep domain experience, and a vast installed base to serve a variety of high-growth verticals.

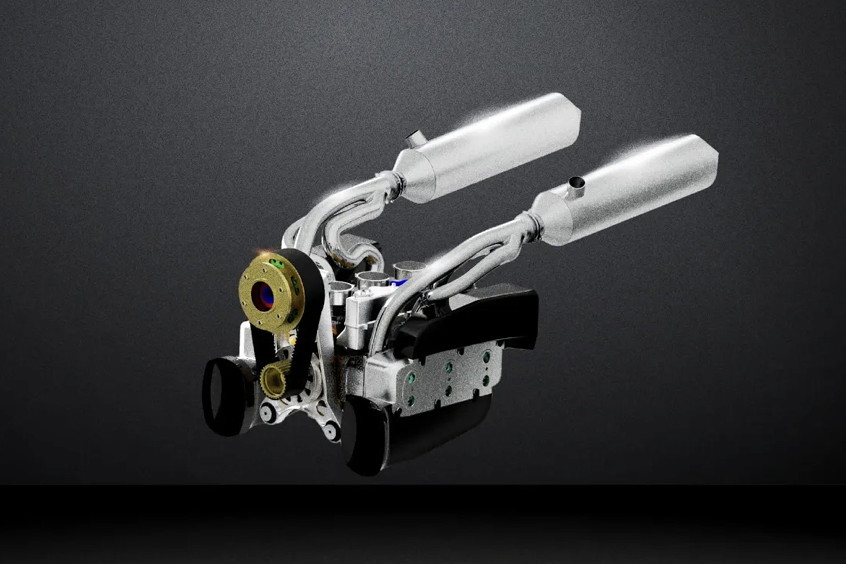

Honeywell Aerospace: Honeywell Aerospace technology and solutions are used on virtually every commercial and defense aircraft platform worldwide and include aircraft propulsion, cockpit and navigation systems, and auxiliary power systems. With $15 billion in annual revenue in 2024 and a large, global installed base, Honeywell Aerospace will be one of the largest publicly traded, pure play aerospace suppliers, with leading positions in technology and systems that will continue to deliver the future of aviation through increasing electrification and autonomy of flight.

Advanced Materials: The Advanced Materials business will be a sustainability-focused specialty chemicals and materials pure play with leading positions across fluorine products, electronic materials, industrial grade fibers, and healthcare packaging solutions. With nearly $4 billion in revenue last year, Advanced Materials offers leading technologies with premier brands, including the breakthrough low global warming Solstice hydrofluoro-olefin (HFO) technology. As a standalone company with a large-scale domestic manufacturing base, it will be positioned to benefit from a compelling investment profile and a more flexible and optimized capital allocation strategy.

Honeywell's Continued Simplification and Portfolio Optimization

Honeywell remains on pace to exceed its commitment to deploy at least $25 billion toward high-return capital expenditures, dividends, opportunistic share purchases and accretive acquisitions through 2025. The company intends to continue its portfolio transformation efforts during the separation planning process to enhance the value proposition of each business.

Since December 2023, Honeywell has announced a number of strategic actions to drive organic growth and simplify its portfolio. This includes approximately $9 billion of accretive acquisitions: the Access Solutions business from Carrier Global, Civitanavi Systems, CAES Systems, and the liquefied natural gas (LNG) business from Air Products. In addition, the company entered into an agreement to divest its Personal Protective Equipment business which is expected to close in the first half of 2025.

Transaction Details

The planned separation of Automation and Aerospace is expected to be achieved in a manner that is tax-free to Honeywell shareholders and targeted for completion in the second half of 2026, subject to certain customary conditions, including, among others, the filing and effectiveness of applicable filings (including a Form 10 registration statement) with the U.S. Securities and Exchange Commission, receipt of customary confirmation that the separation is expected to be tax-free to Honeywell's shareholders, and receipt of applicable regulatory and other customary approvals and final approval by Honeywell's board of directors.

The company is continuing to execute on its previously announced spin-off of its Advanced Materials business, which is expected to be completed by the end of 2025 or early in 2026. The three independent companies will be appropriately capitalized with the financial flexibility to take advantage of future growth opportunities. Honeywell Automation and Honeywell Aerospace are each expected to maintain a strong investment grade credit rating.

Goldman Sachs & Co. LLC served as lead financial advisor to Honeywell in its strategic portfolio review. Centerview Partners LLC also provided financial advice to Honeywell. Skadden, Arps, Slate, Meagher & Flom LLP provided external legal counsel.

| Contact details from our directory: | |

| Honeywell Aerospace | Air Conditioning Equipment, Air Conditioning Equipment, Magnetometers, Cockpit Printers, Airborne Communication Systems, Cooling Systems, Cargo Systems, Airspeed Indicators, WAAS Equipment, Starter Generators, Bleed Air Systems, Air Purification Systems, Flight Management Systems, Engine Parts, Pneumatic Systems Equipment, Automatic Flight Control Systems, Inertial Components & Systems, Multi-Mode Receivers (MMR), Auxiliary Power Units, Cabin Pressure Control Systems, Autopilots, Cockpit Control Systems, Avionics Management Systems, Automatic Direction Finders, Distance Measuring Equipment, Transceivers, VOR (Omnirange) Receivers, Radio Communications Equipment, GPS, Attitude and Heading Reference Systems, Radar/Radio Altimeters, Terrain Awareness and Warning Systems, Horizontal Situation Indicator, Heading Indicators, Onboard Intercom Systems, Electronic Flight Instrument Systems, Flight Recorders, Collision Avoidance Systems/TCAS, Fly-by-Wire Systems, Air Data Computers, Cabin Management Systems, Weather Mapping Radar, Emergency Locator Transmitters, Radar Transponders, IFF Interrogators, Glide Slope Receivers, Weapons Countermeasures, LCD Displays, Moving Maps, Enhanced Vision Systems (EVS), Inflight Entertainment, Angle of Attack Indicators, Proximity Sensors, Testing Services, Environmental Testing Services, Electromagnetic Test Services, Electric Power Controllers, Cockpit Video Displays, Fibre Optic Gyroscopes, Fuel Tanks & Systems, Precoolers |

| Civitanavi Systems Srl | Fibre Optic Gyroscopes, Inertial Components & Systems |

| CAES (Cobham Advanced Electronic Solutions) | Test Sets, Test Equipment, Spectrum Analysers, Microwave Testing, Signal Generator Test Equipment, Electronic Components, Power Conversion Equipment |

| Air Products & Chemicals, Inc. | Fuel Tanks & Systems |

| Related directory sectors: |

| Indicators and Instruments |

Weekly news by email:

See the latest Bulletin, and sign up free‑of‑charge for future editions.

EDGE launches Powertech for high-performance aero engines

GE uses exascale supercomputers for Open Fan engine

Embraer begins assembly of Austria’s first C-390